Global investors were increasingly betting on a victory for Republican Donald Trump late Tuesday, as the former president took the lead in the U.S. presidential race, with results from key battleground states still pending.

U.S. stock futures, the dollar, Treasury yields, and bitcoin all saw gains—signals that analysts and investors view as favorable for a Trump win over Democrat Kamala Harris.

“Our county-by-county analysis in crucial states shows Harris is underperforming compared to 2020, which suggests the market is beginning to price in a Trump victory, as reflected in movements in bonds and the dollar,” said Jens Nordvig, CEO of the analytical firm Exante.

The results so far highlight how this highly unusual and closely contested election could have significant implications for tax policy, trade, and U.S. institutions.

The outcome of the election will impact global assets and shape the future of U.S. debt, the dollar’s strength, and various industries that form the foundation of Corporate America.

As the evening unfolded, polls indicated a tight race between the former president and the current vice president. By 11 p.m. ET, Trump had secured 211 Electoral College votes, while Harris had 145, with one-third of the vote counted.

Republicans also gained control of the U.S. Senate, guaranteeing their dominance of at least one chamber of Congress next year.

**RISING CONFIDENCE**

Despite lingering uncertainty, popular election betting platforms heavily favored Trump, and market activity in assets tied to his policy proposals—such as raising tariffs, cutting taxes, and rolling back regulations—reflected growing optimism about a Trump victory by Tuesday evening.

“The result would likely lead to higher interest rates,” said Nick Ferres, chief investment officer at Vantage Point Asset Management in Singapore. He was purchasing bank stocks, anticipating that higher yields and stronger economic growth would boost their earnings.

Bank shares in Tokyo climbed 4.4%, outperforming the broader market in Australia.

Shares of Trump Media and Technology Group surged by 10% in after-hours trading following a volatile day, while the Mexican peso, which could be impacted by tariffs, dropped to a two-year low, weakening by about 3% from its previous closing price. The euro also fell amid concerns that a Trump presidency might lead to new trade tariffs on Europe and higher defense costs for the region.

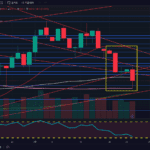

Bitcoin soared to a record high in Asian markets, with traders betting that a Trump win could lead to a more relaxed stance on cryptocurrency regulation.

“Markets are becoming more confident that the election outcome will be settled quickly, and that a ‘red wave’ in Congress is within reach,” said Ben Emons, founder of Fedwatch Advisors in Washington.

Several investors noted that, unlike in 2020, when Joe Biden’s victory wasn’t confirmed for several days, the results so far suggest the markets will gain clarity much sooner.

“One of the biggest market concerns has been a prolonged dispute over the election outcome,” said Jamie Cox, managing partner at Harris Financial Group.