Oil prices continued to rise on Friday, poised for a weekly gain of over 4%, driven by escalating tensions in the Ukraine war and warnings from Russian President Vladimir Putin about the potential for a global conflict.

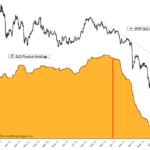

By 0448 GMT, Brent crude futures increased by 10 cents (0.1%) to $74.33 per barrel, while U.S. West Texas Intermediate (WTI) crude futures rose by 13 cents (0.2%) to $70.23 per barrel. Both benchmarks surged 2% on Thursday, marking their best weekly performance since late September, as Russia intensified its military actions after the U.S. and Britain allowed Ukraine to use their weapons to strike Russian targets.

Putin announced on Thursday that Russia had launched a ballistic missile at Ukraine and warned of heightened risks to global stability, potentially disrupting oil supplies from one of the world’s largest producers. Despite output cuts and sanctions, Russia reported producing around 9 million barrels per day this month, while OPEC+ continued implementing supply curbs.

Meanwhile, Ukraine has targeted Russian oil facilities with drones, including a June attack that struck four refineries. However, rising U.S. crude and gasoline inventories, coupled with projections of surplus supply in 2024, limited further price increases.

Goldman Sachs analysts, led by Daan Struyven, stated in a note that they expect Brent prices to remain within the $70–$85 range, constrained by ample spare capacity and the supply elasticity of OPEC and U.S. shale producers.

“The risks of oil prices breaking higher are increasing,” analysts noted, suggesting Brent crude could reach approximately $85 per barrel in the first half of 2025 if tighter sanctions under U.S. President-elect Donald Trump’s administration reduce Iranian oil supply by 1 million barrels per day.

Some experts anticipate a further increase in U.S. oil inventories in next week’s data. Jim Ritterbusch of Ritterbusch and Associates in Florida commented, “We expect a rebound in production and U.S. refinery activity next week, which could negatively impact both crude and key product prices.”

Meanwhile, China, the world’s largest crude importer, announced policy measures on Thursday aimed at boosting trade, including support for energy product imports. These measures come amid concerns over Trump’s potential tariff threats.