Gold prices climbed in Asian trading on Tuesday, building on their recovery from two-month lows as the dollar eased from recent highs. Heightened tensions between Russia and Ukraine further fueled demand for the safe-haven asset.

The precious metal saw a sharp rebound earlier this week, as a decline in risk-driven assets following Donald Trump’s victory in the 2024 presidential election contributed to the recovery.

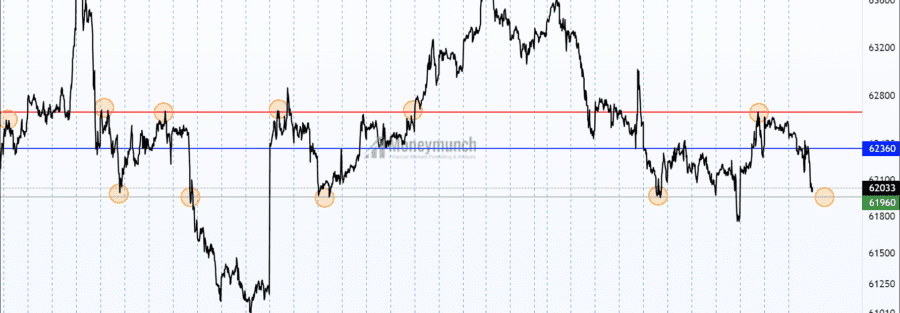

Spot gold rose 0.4% to $2,622.59 an ounce, while December gold futures gained 0.5%, reaching $2,626.90 an ounce by 23:20 ET (04:20 GMT). Spot prices had already surged nearly 2% on Monday.

Gold draws support from safe-haven demand amid the ongoing Russia-Ukraine conflict.

Over the weekend, media reports indicated that the U.S. had approved Ukraine’s use of long-range missiles to strike deeper into Russian territory.

In response, Russia issued warnings of severe consequences if Ukraine proceeded with such attacks, while continuing its own missile strikes on multiple Ukrainian regions.

The possibility of Ukraine utilizing long-range missiles to target Russia could significantly escalate the ongoing conflict, bolstering gold’s appeal as a safe-haven asset.

Dollar and Yields Decline on Rate Cut Speculation

Gold and other metals also found support from a weaker dollar and declining Treasury yields, as investors increasingly anticipate a near-term reduction in U.S. interest rates.

The dollar retreated from a one-year high over the past two sessions, while the 10-year Treasury yield eased after reaching a five-month peak last week.

The dollar weakened following last week’s strong inflation data and the Federal Reserve’s less dovish stance, which only slightly dampened expectations of a December rate cut.

Traders priced in a 55.7% probability of a 25-basis-point rate cut in December and a 44.3% likelihood that rates would remain unchanged, according to CME FedWatch.

**Precious Metals Gain Ground**

Other precious metals showed positive momentum on Tuesday. Platinum futures edged up 0.3% to $976.75 an ounce, while silver futures climbed 0.6% to $31.422 an ounce.

**Industrial Metals Recover Modestly**

Copper prices found some relief from the dollar’s recent weakness, although the metal remained under pressure from steep losses over the past month due to ongoing concerns about slowing demand in China, the world’s largest importer.

Benchmark copper futures on the London Metal Exchange gained 0.3% to $9,124.50 a ton, while December copper futures rose 0.5% to $4.1440 a pound.

The People’s Bank of China is scheduled to announce its benchmark loan prime rate decision on Wednesday.