Our Service area

Learn something more from our blog

December 19, 2024

Here is the image depicting the dramatic stock market drop following the Fed’s rate cut and signal of slower easing in 2025.

U.S. stocks plummeted on Wednesday, marking the largest daily decline in months for all three major indexes. The drop followed the Federal Reserve’s decision to lower interest rates by a quarter percentage point, accompanied by projections signaling a more cautious approach to easing in 2025. The Fed reduced rates by

Most Asian currencies weakened on Thursday, with the yen falling to a near one-month low after the Bank of Japan kept interest rates unchanged and signaled a cautious outlook. However, the primary pressure on Asian currencies came from a stronger dollar, which surged to a more than two-year high following

December 19, 2024

The dollar strengthens across the board, while the yen declines following the BOJ’s decision to hold rates

The dollar approached a two-year high on Thursday after the Federal Reserve signaled a slower pace of rate cuts for 2025, while the yen dipped following the Bank of Japan’s (BOJ) decision to keep rates unchanged. As anticipated, the BOJ held interest rates steady, though a proposal from one dissenting

December 19, 2024

The Bank of Japan maintains steady rates, anticipating an increase in inflation by 2025

The Bank of Japan (BOJ) left interest rates unchanged on Thursday in a nearly unanimous decision, reflecting caution over Japan’s economic outlook and inflation trajectory. The BOJ maintained its short-term policy rate at 0.25%, aligning with expectations from a Reuters poll. Eight of the nine board members supported the decision,

Federal Reserve Poised for Third Rate Cut as Honda-Nissan Merger and Market Trends Take Center Stage 1. Fed Expected to Deliver Another Rate CutThe Federal Reserve is widely anticipated to announce its third consecutive 25-basis-point rate cut at its final policy meeting of the year on Wednesday. Markets have largely

U.S. stock index futures edged higher on Wednesday, rebounding from Tuesday’s decline on Wall Street, as investors looked ahead to the Federal Reserve’s anticipated interest rate cut. Markets have fully factored in a 25 basis point rate cut following the conclusion of the Fed meeting on Wednesday. However, attention will

The U.S. dollar remained steady on Wednesday as investors awaited the Federal Reserve’s upcoming decision, speculating whether it might take a hawkish approach to a rate cut amid a week of major central bank meetings. This anticipation pressured the Australian and New Zealand dollars to new lows. The Fed is

Bernstein has raised its price target for Amazon.com Inc. in anticipation of strong long-term growth driven by operational efficiency and sustained momentum across its business segments. The new target is $265, up from $235, with an “Outperform” rating maintained. Key drivers of this growth include solid performances in Amazon’s core

December 18, 2024

“UK consumer inflation accelerates for the second consecutive month, with the Consumer Price Index (CPI) increasing by 2.6%.”

UK inflation rose for the second consecutive month, solidifying expectations that the Bank of England (BoE) will keep interest rates unchanged at its upcoming meeting later this week. Annual consumer price inflation increased to 2.6% in November, up from 2.3% in October, moving further away from the BoE’s 2.9% medium-term

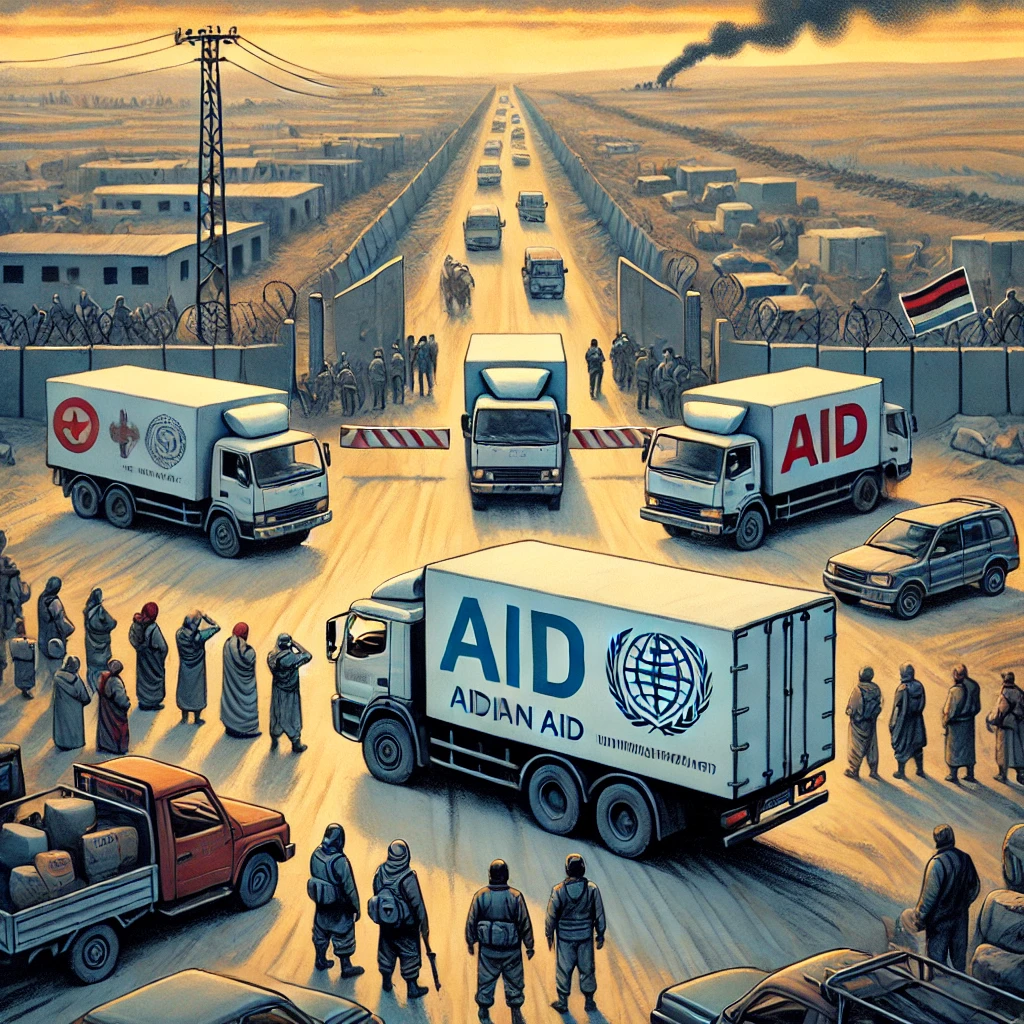

Khartoum, Dec 18 (IANS): The World Food Programme (WFP) has reported that escalating conflict in Sudan is obstructing the delivery of humanitarian aid to areas at risk of famine. According to Xinhua News Agency, WFP stated, “Fighting in Um Rawwaba, North Kordofan, has prevented a convoy from reaching famine-risk regions