U.S. stock index futures inched higher on Monday evening, recovering some of the ground lost during recent trading sessions. This came as investors adopted a cautious stance ahead of a busy week, with a tight presidential election and a Federal Reserve meeting on the horizon.

Futures for the S&P 500, Nasdaq 100, and Dow Jones each ticked up by 0.1%, providing some relief after Wall Street posted further declines earlier in the day. The selloff was driven by a cautious risk sentiment, compounded by last week’s strong inflation data, which raised concerns that the Federal Reserve may adopt a more hawkish stance in its upcoming meeting.

By 18:13 ET (23:13 GMT), S&P 500 futures stood at 5,748 points, Nasdaq 100 futures were at 20,110 points, and Dow Jones futures reached 41,980 points.

Trump and Harris are heading into a closely contested presidential race, with recent polls indicating a tight race as Election Day approaches on Tuesday.

Earlier polls had suggested Trump was gaining ground on Harris, but this trend seems to have shifted in the lead-up to the election. Trump is expected to introduce more inflationary policies and increase trade tariffs on China, a move that analysts believe could negatively impact the tech sector. Harris has suggested raising taxes on high-net-worth individuals and large corporations while reducing the tax burden on families.

Meanwhile, attention this week is on a Federal Reserve meeting, with expectations that the central bank will lower interest rates by 25 basis points, following a 50 basis point cut in September.

Recent data indicating persistent inflation and a strong U.S. economy have raised questions about the extent to which interest rates will decline in the coming months, especially as the Federal Reserve has emphasized a data-driven approach to any further rate cuts.

However, weaker-than-expected nonfarm payrolls data released on Friday suggests the labor market is cooling, which could influence the Fed to lean towards further easing.

Attention will now turn to remarks from Chair Jerome Powell, where he is expected to outline the Fed’s strategy for potential rate cuts moving forward. Wall Street remains in a holding pattern, with major indexes trading within a narrow range over the last two sessions, though they are still grappling with significant losses from the prior week.

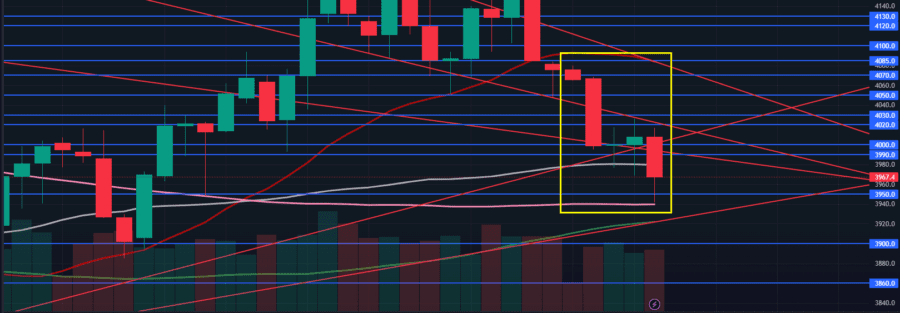

Wall Street remained rangebound on Monday, as major indexes struggled to gain momentum and continued to nurse losses from the previous week. The S&P 500 slid 0.3% to close at 5,712.69, while the NASDAQ Composite also fell 0.3%, ending the session at 18,182.93. The Dow Jones Industrial Average posted a larger decline of 0.6%, settling at 41,794.60.

Mixed earnings reports added to the uncertainty, with tech stocks still in focus following a series of lackluster results. Berkshire Hathaway Inc. (NYSE:BRKa) dropped 2% after its operating earnings fell short of Wall Street’s expectations, contributing to the overall cautious sentiment in the market.

On the other hand, Palantir Technologies Inc (NYSE:PLTR), a data software company, saw a nearly 13% increase in after-hours trading following an earnings report that surpassed expectations.

Dollar Tree Inc (NASDAQ:DLTR) gained 6.3% after announcing that CEO Rick Dreiling would step down, with Chief Operating Officer Michael Creedon Jr. appointed as interim CEO.